SECURE YOUR

RETIREMENT

query_statsFocused

Asset Preservation.

new_releasesCommitted

Asset Preservation.

Income Security.

savingsTransparent

Fee-Based

Investment Advisor.

No Commissions.

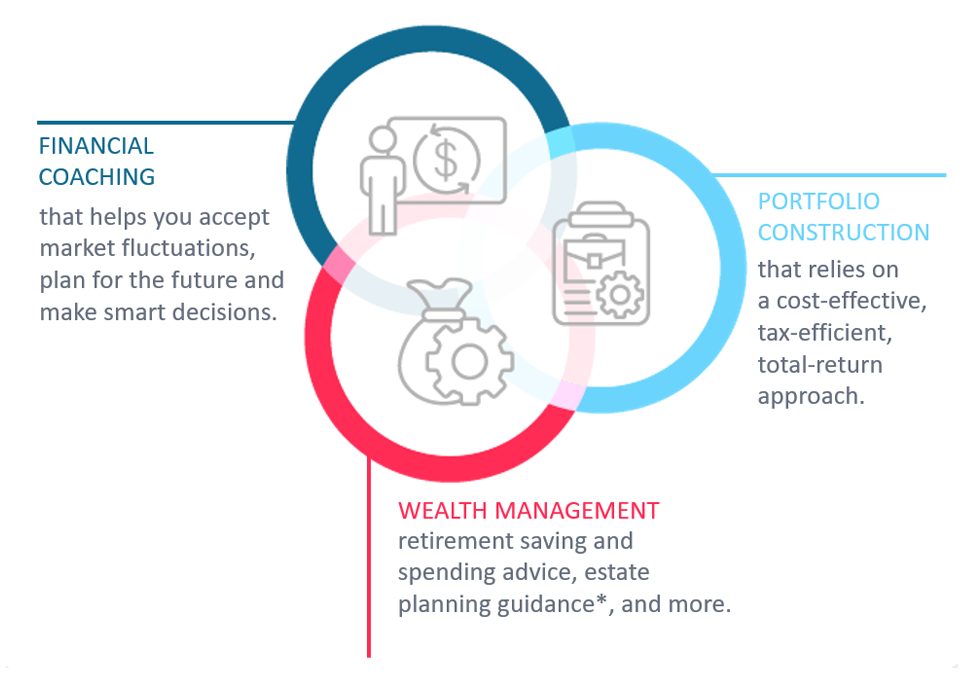

Our primary goal is to provide clients with income security and asset preservation strategies. We achieve this objective by taking an individual approach with each client, based on their unique circumstances. We then implement and monitor the plan over time, which allows us to help them achieve their ultimae goal of income safety and overall financial security throughout retirement.